We're here to help you get the most out of your deductible health plan!

How does a deductible health plan work?

Your deductible is the total amount you will pay annually for certain covered medical and prescription services and supplies before WHA will cover expenses.

Copayments are typically smaller dollar amounts or percentages. Some plans will always have you pay a copayment for a service while other plans only require one once you reach your annual deductible.

Once your deductible and copayment costs reach your annual out-of-pocket (or OOP) maximum, you are done paying for expenses. WHA will cover 100 percent of your covered services for the remainder of the calendar year.

Get Started Managing Your Deductible Health Plan

1. |

Setup your MyWHA account.WHA offers you personalized online resources to make it easier to manage your health plan with the convenience of any-time access. To access your MyWHA account:

|

|

2. |

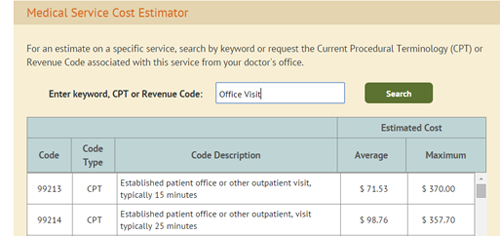

Know before you go.With a deductible plan, you are responsible for out-of-pocket health care costs until the deductible is met, so knowing the cost of a service or procedure in advance can help you better plan your health care expenses.

|

|

3. |

Go to the doctor.Preventive health care services such as your annual wellness visit and immunizations are FREE. View a list of recommended preventive services based on your individual health needs. Remember: It’s unwise to avoid the doctor when you have a problem. If an urgent care situation arises while you’re in WHA’s service area, call your primary care physician. Delaying care could cost you substantially more. |

|

4. |

Show your member ID card.When you receive services for medical care, be sure to present your WHA member ID card. Your ID card will inform the provider if, and how much you are responsible for the cost of service(s). Please note: If you are responsible for the cost of service, it could take a few months from the date of service to receive a bill from your provider. |

|

5. |

When you get a bill, check your accumulator.Login in to your MyWHA account and make sure the amount you are being billed was applied to your deductible. Your invoice should reflect an insurance adjustment that represents your exclusive WHA member rate. Keep a copy of all your medical receipts. WHA keeps track of your deductibles and out-of-pocket costs, but it’s still a good idea to keep copies of your medical expense receipts. |

|

6. |

Save on medications.Ask your doctor if a generic exists for the drug he or she wants to prescribe. Create an online account with our pharmacy benefit manager, OptumRx, to take advantage of the money saving mail-order program. Once you sign up with OptumRx, you can access your pharmacy information and price your prescriptions directly via your MyRESOURCES tool bar. |

|

If your deductible plan is HSA-compatible, learn how a Health Savings Account (HSA) works with your deductible health plan.

We are currently enhancing the online renewal system. Please check back soon. For immediate assistance, contact a WHA Individual Plan Specialist at 888.563.2250 or individualsales@westernhealth.com.

MyTOOLS

MyDOCUMENTS

This SBC is currently unavailable online.

For assistance, please contact WHA Sales as described below.

Call 888.563.2250 or email individualsales@westernhealth.com.

Este documento en español está siendo actualizado y no está disponible en línea. Por favor de, llamar a Servicio al Cliente 888.563.2250 para solicitar que se le envíe por correo.